How effective is digital transformation in Digibank?

What is digital transformation in banking?

For a detailed definition, please refer to the previous article from CMC TS: What is Digital Banking? Differentiate from Internet Banking?

Digital transformation in banking has banks of all sizes scrambling to adopt new technologies and services on a large scale. But what does digital transformation in banking really mean?

Digital transformation in banking primarily requires a shift to the delivery of digital and online services, as well as a large number of ancillary changes needed to support this transition.

Many banks make the mistake of launching a series of separate digital initiatives, which have struggled to succeed because they don't have the support or coordination to compete with native digital solutions. Instead, digital transformation in banking must include a top-down approach that integrates digital systems, customer experience platforms, applications, and infrastructure.

Examples of digital transformation in banking:

- Applying blockchain technology

- Using artificial intelligence (AI)

- Collect, manage and analyze customer data

Regardless of which technologies are applied or used, for digital transformation in the banking industry to be effective, certain organizations need to ensure that they adhere to the principles outlined below.

Digital transformation in banking needs to evolve the customer journey

All banks have a website, most have some form of digital application and possibly online services and features that go with it.

These digital features include most of what people think of as “digital services” but do not include digital transformation in banking. However, they allow you to take an important step in your bank's digital transformation, which is digitizing the customer journey. So what needs to be done? And what does it require?

The traditional customer journey or sales process typically begins with building marketing leads, converting those leads into sales, and then moving those sales into services. client.

An individual must go through several departments before they receive a product or service, resulting in a fragmented and disconnected or often non-personalized outcome.

Digital transformation in banking allows you to create a more personal and engaged digital customer journey. Creating a digital customer journey means taking steps to integrate everything into a single online platform so that customers are handled through the same tools, sometimes by the same people and with the same people. information throughout the process. Here, methods like changing the way the team is organized, integrating technical staff into the sales team, and possibly merging marketing and retail into the same team can be of great help.

The most important aspect of digitizing the customer journey is that customers are seamlessly moved from marketing to sales as part of an online application. For example, a digitized customer journey that allows customers to click ads, sign up for an online account, receive instructions and information through their app, receive loan decisions, and pay bills or send money online.

Digital transformation in banking means understanding the wants and needs of customers and investing in those wants and needs. This will save you money and growth in the long run as it improves customer satisfaction, frees up employees for value-added activities like relationship building and ultimately saves time. time by automating processes.

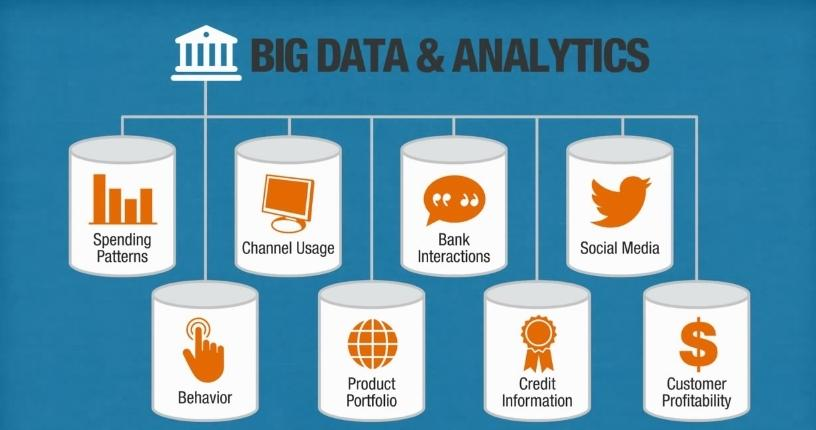

Digitization and Big Data in Banking Digital Transformation

Modern banks have enormous amounts of data. The more digital services you provide, the more data you collect. This data allows you to take important steps in updating and managing your operating model, customer service, and even your business strategy.

Data allows you to understand your customers in new ways, use that information to identify opportunities, optimize products and services, and automate solutions.

Data mining and big data in banking plays a vital role in every part of an organization. Sales and marketing are among the most obvious to benefit from the data provided by the bank's digital transformation strategy.

Here, big data allows you to use customer information to create targeted marketing campaigns or financial education. It helps reduce disruption by creating incentives and solutions to prevent customers from leaving.

For example, data analytics that can predict when a customer wants or needs a loan, or even when cross-selling or upselling other products, can also be helpful. This data also allows banks to provide highly personalized offers and solutions, either through a representative or as an automated offer or solution within an application or online portal.

Automation and use of digital-based solutions such as chatbots and AI are also part of many of the bank's digital transformation strategies. AI is built into customer service, providing support, creating accounts, and more. Here, self-service solutions, chatbots, and 24/7 services provide a business advantage while improving the customer experience.

Focus on change with banking digital transformation

While there are many aspects of digital transformation in the banking industry, one of the most important remains the willingness and ability to adapt to change.

Banks are often hampered by security, laws, and strict frameworks that protect customer data and privacy. At the same time, new digital root banking solutions and monetization applications are outpacing traditional banks in terms of growth and customer acquisition. Adapting policies to meet changing consumer needs, quickly adapting to new technology, and responding to changing markets is essential to digital transformation in banking.

This means that true digital transformation in the banking sector requires organizational change from the inside out, focusing not on external services such as online portals and chatbots, but on how the organization is organized. react to change. You will need both to become and maintain a truly digital organization.

Summary

Bank digital transformation is easier said than done, as many banks today are failing in their own digital transformation goals. For reasons ranging from inconsistency or support between new digital applications to a lack of internal flexibility.

However, once a digital culture is achieved, digital platforms and services can bring a lot of value to consumers, especially when powered by automation technology, AI. , big data and blockchain.

Digital transformation of the banking industry is a long way off and businesses need real companions, especially at the beginning of this arduous process. That is also a big reason why CMC TS is always actively developing and consulting more digital transformation solutions for banks in Vietnam.

To get detailed answers and advice from us, please complete the registration form below. The team of experts at CMC TS will contact you as soon as possible.

CMC TS is proud to be the TOP 1 unit in consulting and implementing Digital Transformation and Security solutions for organizations and businesses in Vietnam. CMC TS is currently a partner in implementing IT, digital banking and digital finance projects for many banks - financial institutions and securities companies in Vietnam such as BIDV, VietinBank, Vietcombank, Techcombank, ABBank, CoopBank, PVcomBank, etc. ...